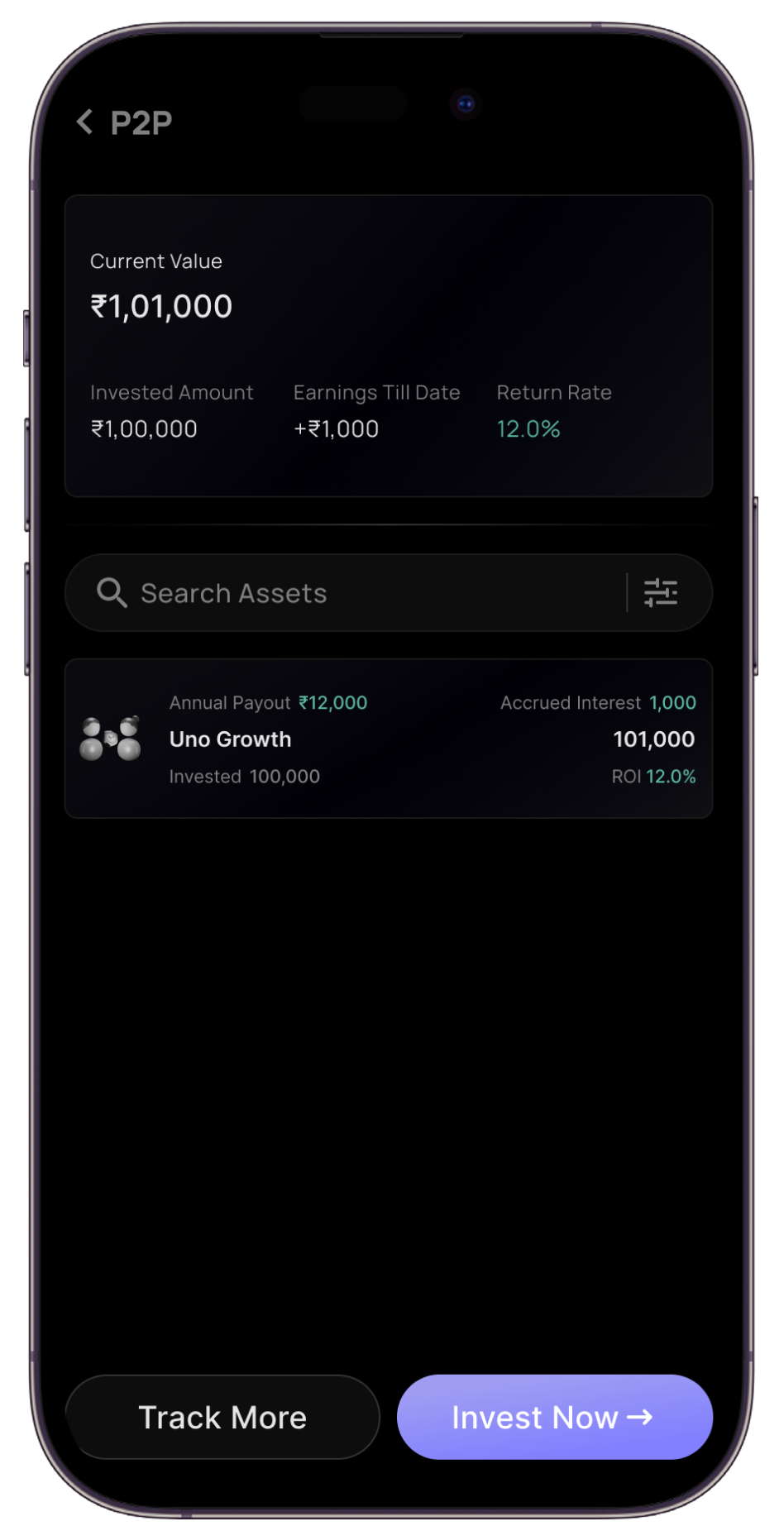

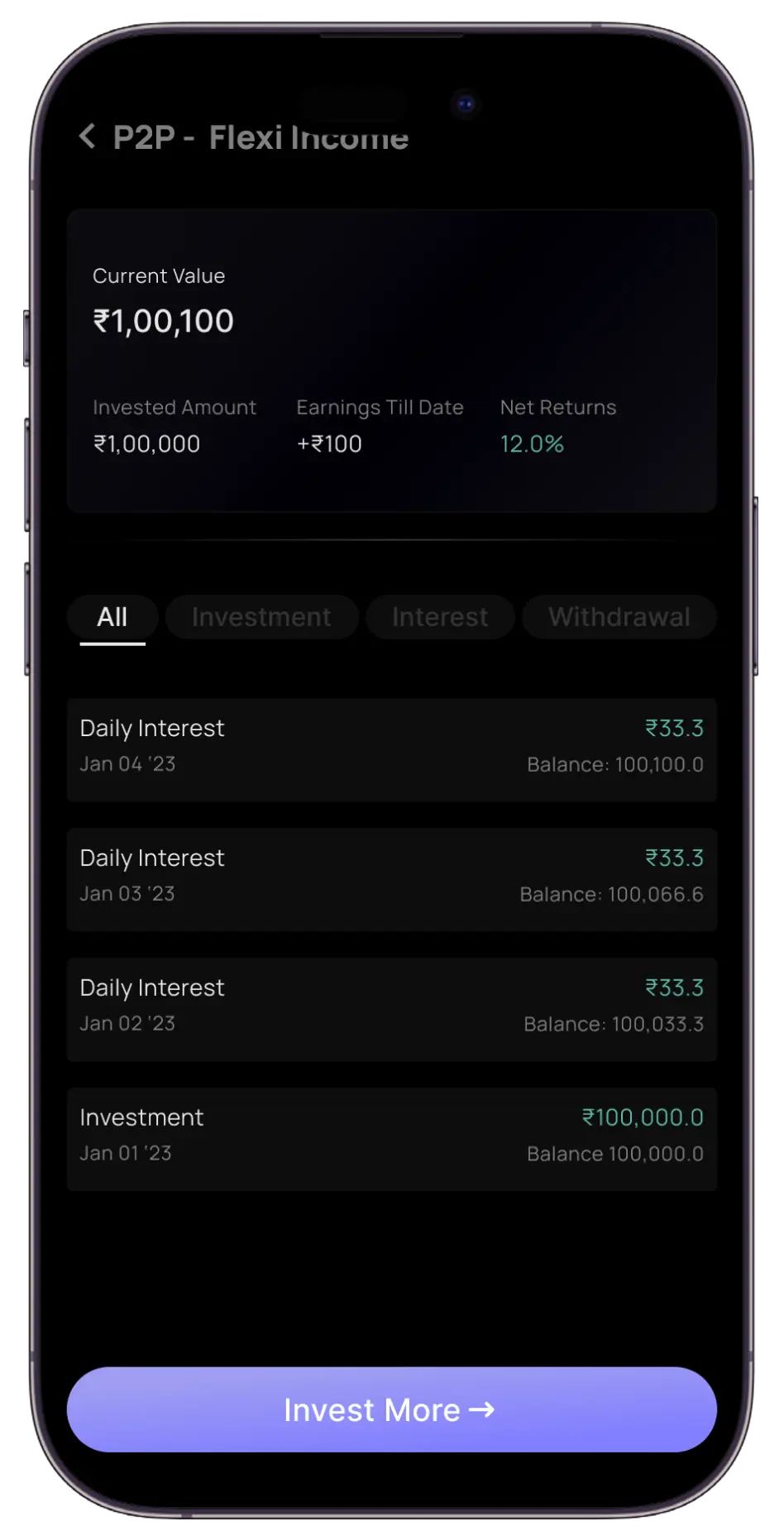

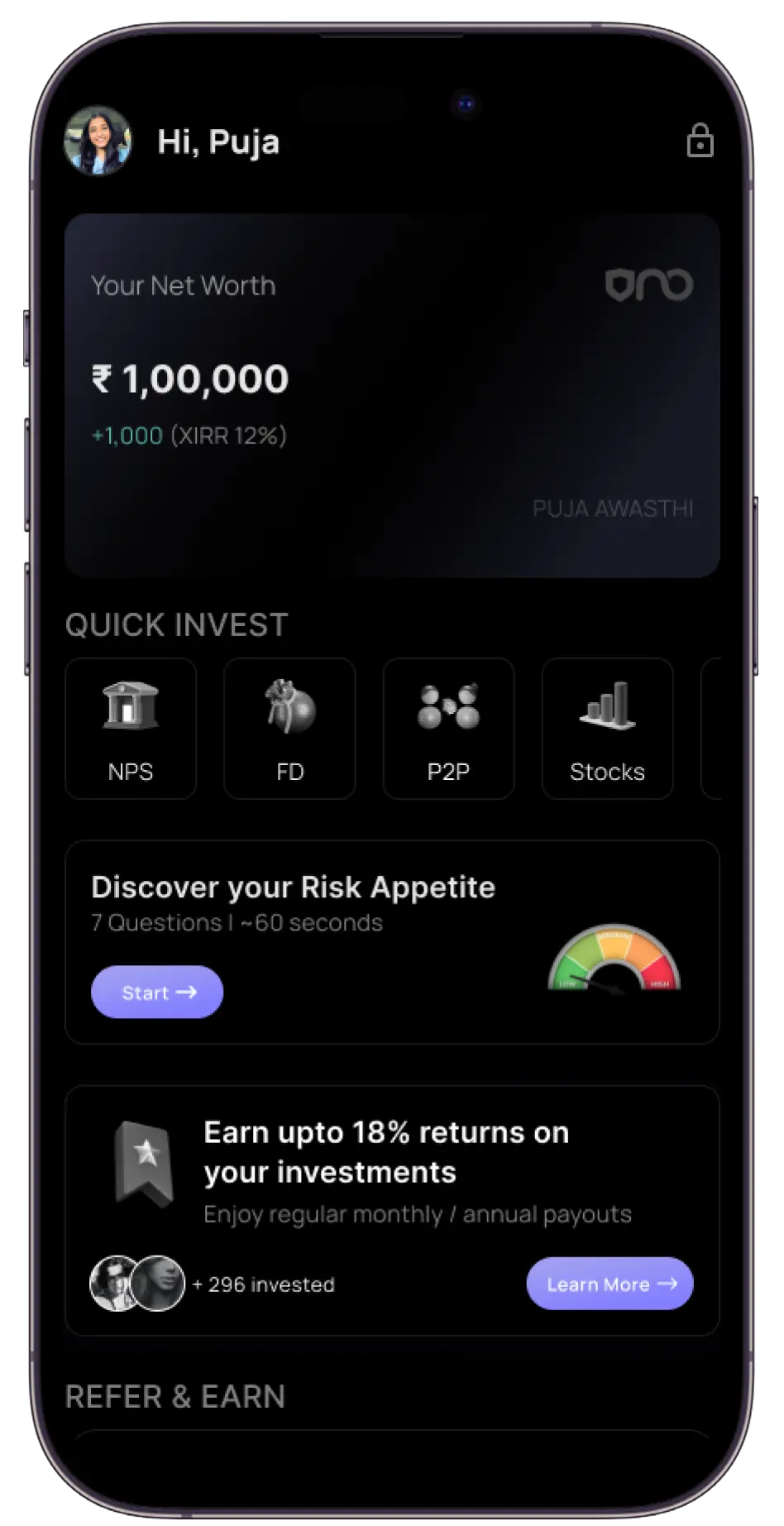

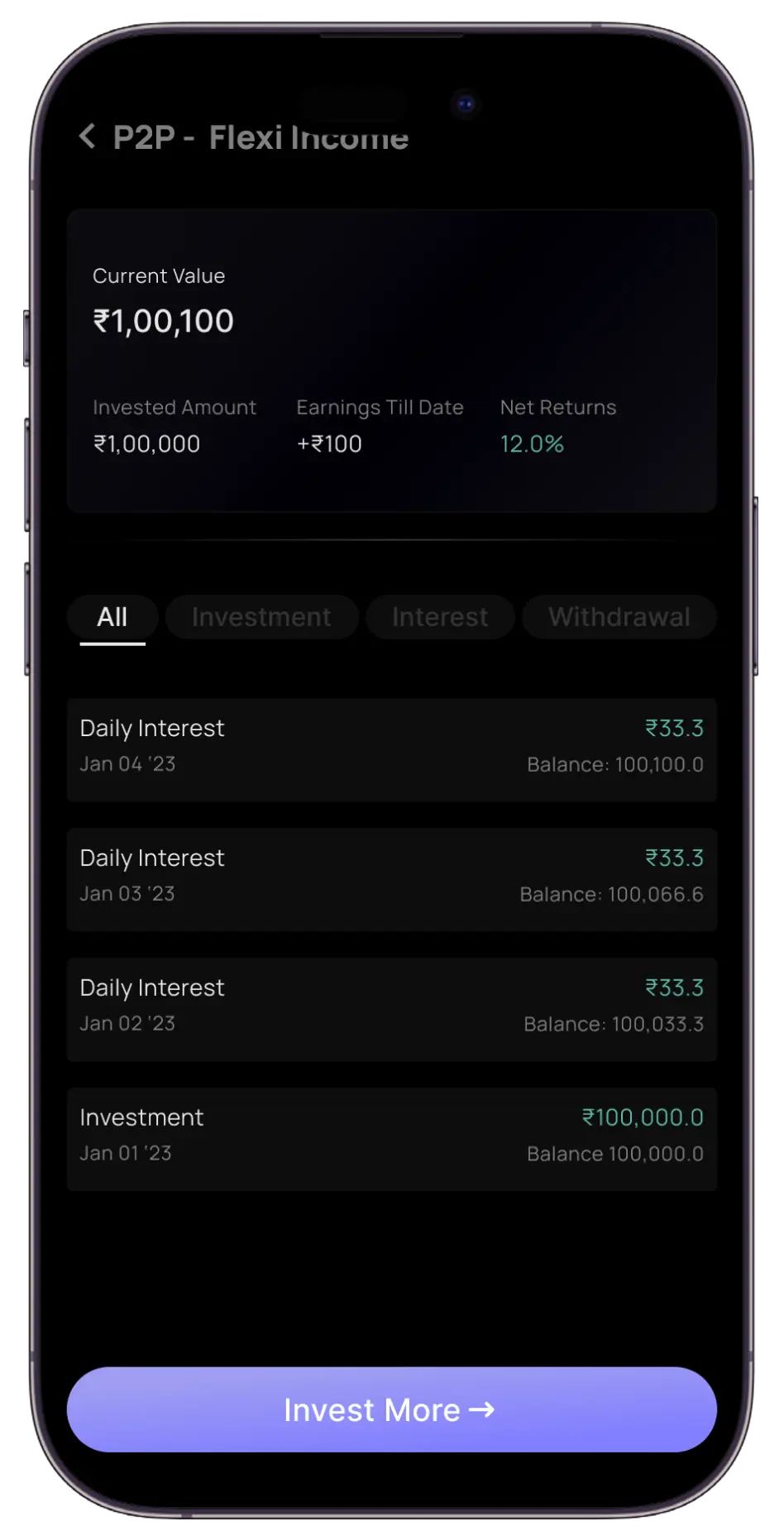

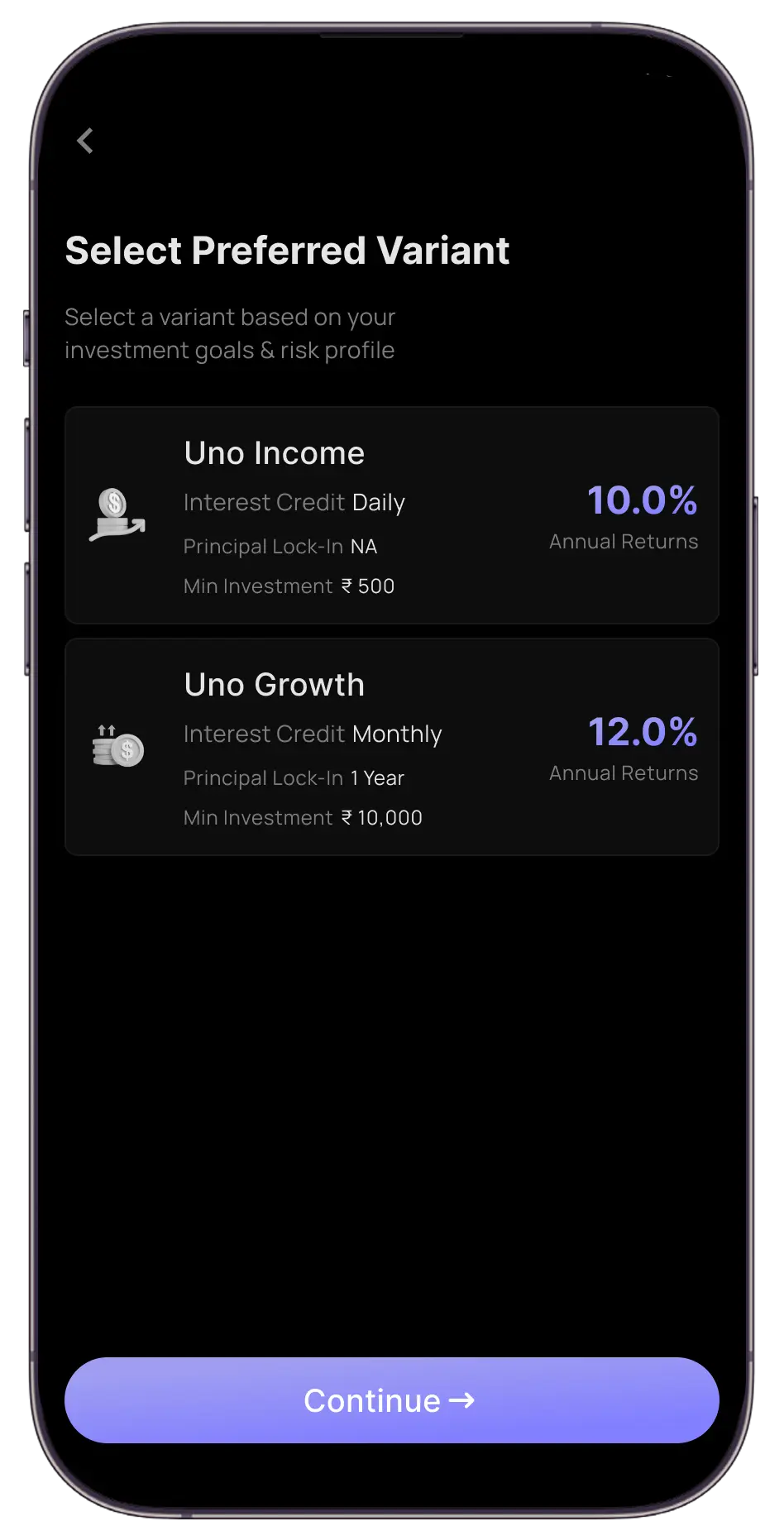

Earn up to 12% per year

Earn ₹ 1,000 per month from ₹ 1 L

Earn regular interest

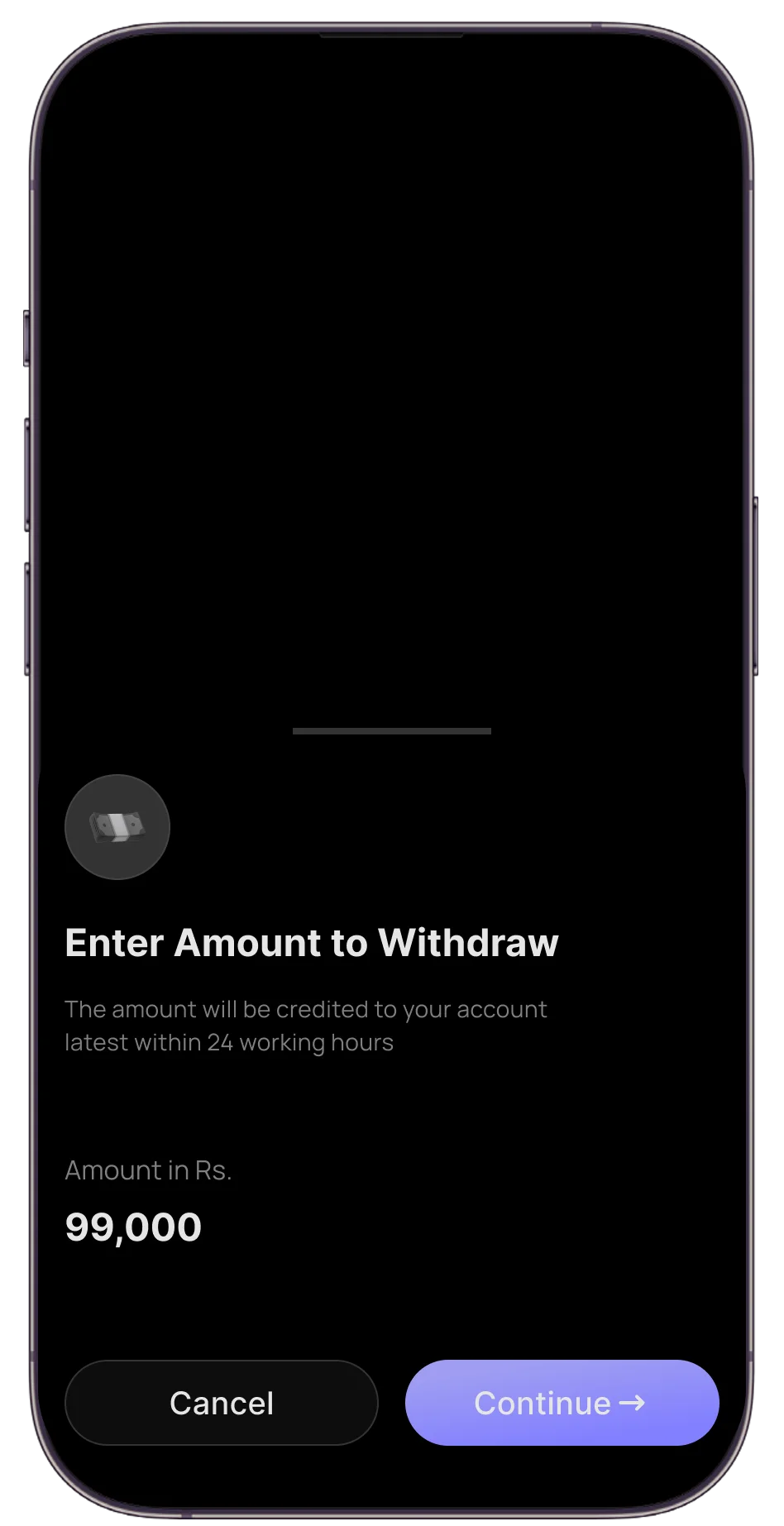

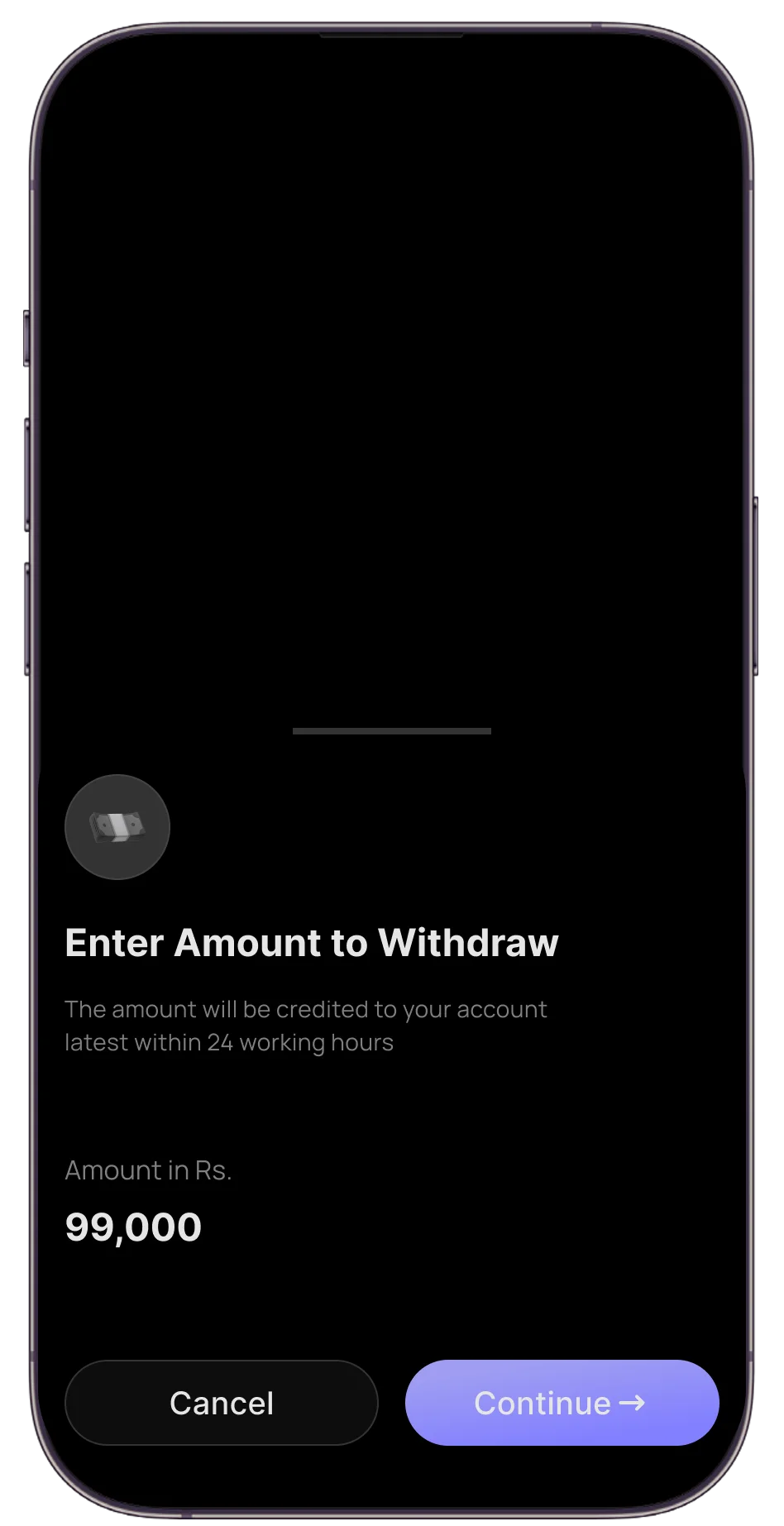

Same day withdrawals

No principal

lock-in

Select your preferred variant

We take your money seriously

Highly Diversification

Thorough Underwriting

Regulatory Compliant

Download Uno Money

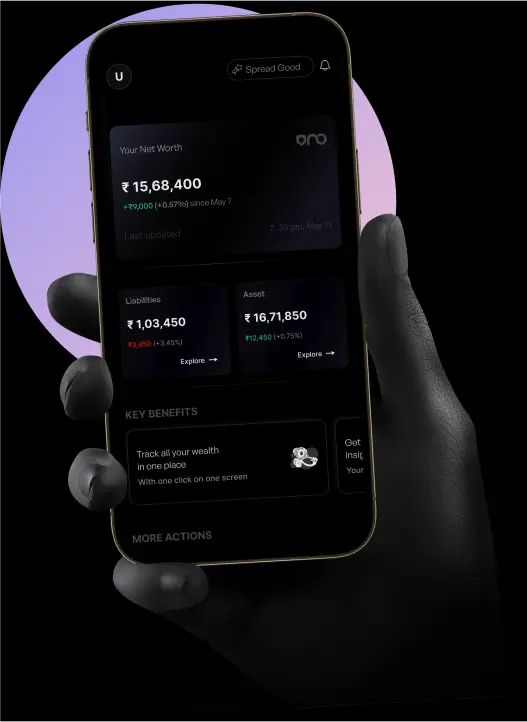

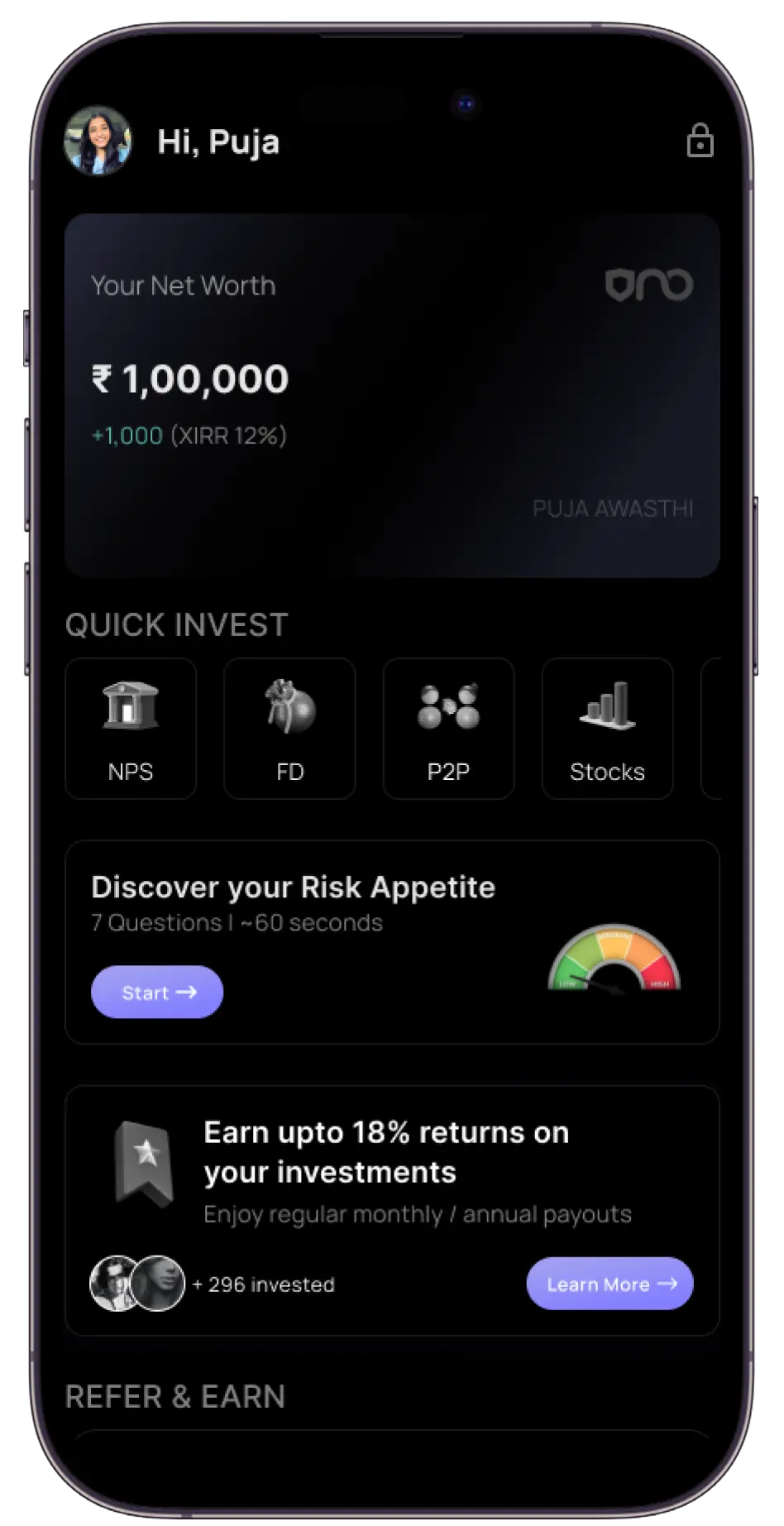

What does Uno Money do?

Uno Money is a wealth super app providing a solution for all your wealth related needs including financial planing, budgeting, investing, portfolio tracking, etc. in a single app.

How do I open an Uno Money account?

Opening Uno Money account is really simple. All you need is to provide your mobile number and verify it with OTP.

Is Uno Money regulated?

Uno Money is registered under Companies Act 2013 and is licensed retirement advisor under Pension Fund Regulatory and Development Authority.

How does Uno Money track my wealth?

Uno Money fetches your financial data from different sources with your explicit consent. For the financial data not available directly from source, we enable you to allow tracking it from your records such as statements, emails etc. or manual entry.

Who does Uno Money look to serve?

Uno money is meant for any one looking to build and manage their wealth in a systematic way. From someone who owns a simple savings account to someone investing in AIFs, Uno Money is meant for all.